Happier consumers. Better results.

Drive improvements in liquidation with the intelligent, digital-first collections platform that puts consumers in control of their own financial health.

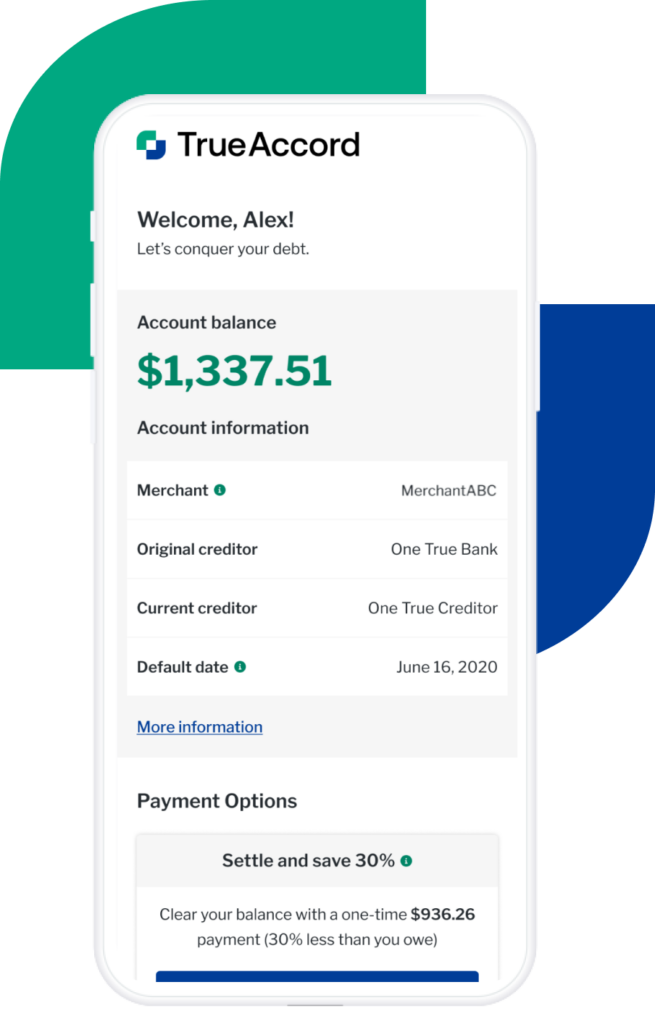

TrueAccord offers late-stage collection services that use machine learning and digital technology to deliver a new kind of consumer experience – driving dramatically higher commitment and resolution.

Boost liquidation rates

Dynamically personalize every step of the consumer journey across digital channels (like email, SMS, voicemail drops, and Facebook), giving consumers tools to self-serve, and ensure that they’re successful once they commit to plans.

Make consumer experience your competitive edge

Harness TrueAccord’s consumer-centric, code-based compliance approach and reputation to protect your brand, lower legal and reputational risk, and work with consumers who want to resolve their debts.

Stay one step ahead

Flexibly scale across any debt volume and monetize any type of debt with a solution built on engagement insights from millions of consumers – and powered by code-based compliance.

The TrueAccord Difference

Harness industry-defining AI.

TrueAccord offers third-party collections powered by Heartbeat — a patented machine learning platform — to dynamically optimize the next best touchpoint for every consumer in real-time.

Intelligence throughout the entire journey.

HeartBeat doesn’t just optimize for engagement and commitment. It leverages engagement signals to identify consumers at risk of breaking plans – and automatically adapts to keep them successful until resolution.

Leading in consumer experience.

Drive consumer trust and engagement with TrueAccord’s brand – and a self-serve digital experience grounded in code-based compliance, inspired by consumer research and the world’s most innovative eCommerce leaders.

Case Study

Klarna’s digital debt collection journey

Learn how Klarna, Europe’s most valuable Fintech brand, made the decision to go from 100% in-house to 100% outsourced collections – improving results, delivering a better consumer experience, and boosting retention.

E-Book

Buyer’s guide to digital debt collection

This definitive guide equips buyers with ten critical questions to ask to understand the difference between digital collections providers and identify the best solution for their organization.

Get started today.

Whatever your organization’s technical needs, we have the tools and experts to onboard you today.